The state is trying to keep residents insured Medicaid if they are eligible or another program such as the federally subsidized Marketplace.

By Annmarie Timmins, New Hampshire Bulletin

The termination of the federal pandemic health emergency permitted states to eliminate Medicaid payments for persons who no longer qualified for the first time since the outbreak. When the moratorium was lifted in March, New Hampshire was one of the first five states to do so.

However, the Department of Health and Human Services claims to have tried to be a leader in keeping people insured, either through Medicaid if they are still qualified, or through another program such as the federally subsidized Marketplace.

This initiative has included the department’s huge multimedia outreach program, which other states have imitated. It has texted, called, emailed, and sent reminders to Medicaid recipients to contact the state for an eligibility check.

More recently, the agency initiated a test attempt to reach those who haven’t answered, potentially leaving them without support even if they qualified.

Background

As of June, that group numbered 17,000 Granite Staters, a small proportion of the over 77,000 persons whose eligibility was renewed between March and June, according to the agency. However, over 44 percent of individuals who lost coverage during that time period.

The agency has arranged for the federal government to make another attempt to reach those non-responders under New Hampshire’s pilot project, with the objective of extending insurance support for individuals who qualify. State Medicaid Director Henry Lipman feels the effort, which no other state is undertaking, has the potential to be a national model.

“One takeaway from this whole experience is that there are things we can do to improve eligibility determinations,” Lipman said. “Those are the lessons we’ll try to take away from this.”

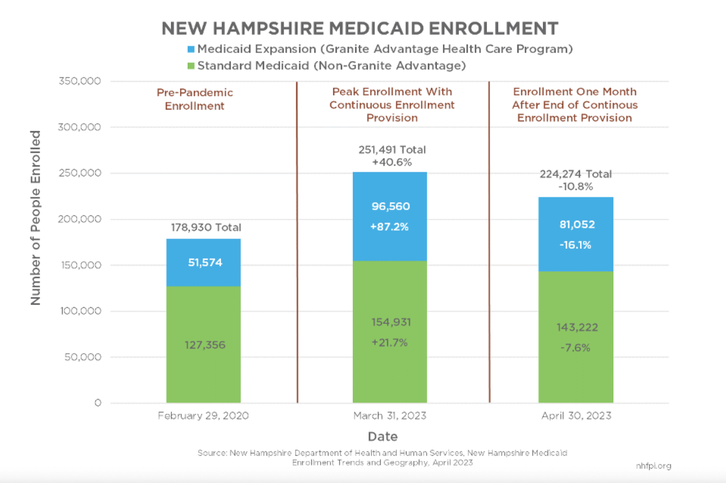

New Hampshire Medicaid Enrollment

Enrollment in expanded Medicaid, which is based only on income, surged during the pandemic because people were unable to work. (Financial Policy Institute of New Hampshire)

Annually, states redetermine Medicaid eligibility. At the outset of the pandemic, they canceled those annual reviews in exchange for more generous federal Medicaid payments. The reintroduction of annual redeterminations has resulted in many people losing Medicaid or switching to the federal Marketplace.

During the first three years of the epidemic, New Hampshire’s Medicaid enrollment skyrocketed, owing primarily to people losing their jobs. According to the agency, enrolment reached 251,400 people between March 2020 and March 2023.

The majority of the rise was accounted for by expanded Medicaid, which is based on income and increased by about 88 percent. According to the New Hampshire Fiscal Policy Institute, approximately 51,570 Granite Staters were on extended Medicaid prior to the epidemic. During the pandemic, this number increased to 96,560.

The number of persons on regular Medicaid, which requires not just a low income but also life or health circumstances unrelated to pandemic shutdowns, increased by about 23%.

The Present Situation

Enrollment in both programs has decreased significantly, particularly in expanded Medicaid, as more people have returned to work. According to department data, the Medicaid population for both programs has reduced to around 190,660 people as of July 17.

As of June, Health and Human Services workers had processed approximately 77,200 renewals. Nearly half of individuals, nearly 37,500, retained their Medicaid coverage, while nearly 17,000 were directed to the federal Marketplace.

People lost Medicaid benefits for a variety of reasons

Almost 13,000 people were judged ineligible because their income had risen above the limit.

About 3,390 people were no longer eligible for Medicaid, maybe because they had reached the age of 65 and switched to Medicare, or because they had received benefits while pregnant. Some people’s living arrangements had altered, possibly because they had gotten married or had more people living in their homes. Or children who got Medicaid while in foster care are now over the age of 26 and no longer qualify.

Because they no longer qualify, about 5,650 people have voluntarily terminated their Medicaid benefits.

The Granite Staters who did not respond to the state’s notifications to have their eligibility assessed were the most likely to lose benefits.

These are the people the state intends to reach through its pilot project.

The state picked specific groups for the initial renewals

The agency started with persons who were expected to lose Medicaid coverage because their income had grown, as well as those who had not utilized their Medicaid benefits in a long time. In June, 75% of those declared no longer eligible had not used their benefit in the previous three months.

“We want to make some changes so that we have more time to work with people who may be having a more difficult time,” Lipman explained.

More vulnerable populations, such as children, persons in long-term care, and those with medical issues, will have their eligibility extended in the coming months. This category also includes those who may require additional time to obtain the paperwork required to prove eligibility.

Lipman stated that the government is increasing its attempts to interact with the families of the 14,000 children whose eligibility must be assessed. In September, the government intends to collaborate with schools to send notifications home with parents. Even if a parent is no longer eligible for Medicaid, their children may be, according to Lipman.

“We’ve spread it out to work with families to make sure that children who shouldn’t be losing coverage don’t,” he explained.

The state has broadened its outreach, encouraging people to renew their licenses. It also allows consumers more time to complete renewals.

Process To Be Part of It

Lipman and his team at Health and Human Services began calling, texting, and sending mail to Medicaid holders well before redeterminations resumed in April. As a result, nearly 30,000 people completed their redetermination by the March 31 deadline.

Lipman said the department is continuing that effort to reach people who are running out of time to complete their redeterminations.

It has called every Medicaid holder who lives in long-term care, is elderly, or has a disability, prompting 57 percent of them to complete the process. It has done the same for households with children, reaching about half of them and completing redeterminations for 37 percent of them.

Staff mailed 120,000 “nudge” letters to those whose redeterminations are overdue or hadn’t submitted all the paperwork required. Thirty percent have responded and completed the process. Lipman said the effort is aimed at ensuring people who are likely to remain eligible don’t lose benefits.

It also plans to extend the amount of time for someone to ask that their denial of Medicaid be reconsidered, from 90 days to 120 days. That’s required staff to work long hours and weekends, Lipman said.

“The only thing we’re going to do by closing them is to cause them potentially to have a health decline and end up being more costly for the state to care for right or they (need) an institutional level of care because they did get the services,” Lipman said. “We are trying to be smart about how we calibrate that component.”

There are several resources for people with questions

The department suggests people respond to its reminder by using the contact information provided.

Individuals can visit nheasy.nh.gov, the state’s online portal to government benefits and local services. The department can also be reached by phone at 1-844-ASK-DHHS (1-844-275-3447), or in person at one of the department’s local offices.

The state’s two federally funded health care “navigator” programs can also assist people with eligibility questions and insurance options, and help them buy a plan through the Marketplace.

First Choice Services (firstchoiceservices.org) and Health Market Connect (hmcnh.com) both provide free assistance in multiple languages. The New Hampshire Insurance Department is another option.

Do you want your company to be featured in The Concord Sentinel? Please contact us!